Enhancing Your Online Business Banking Experience

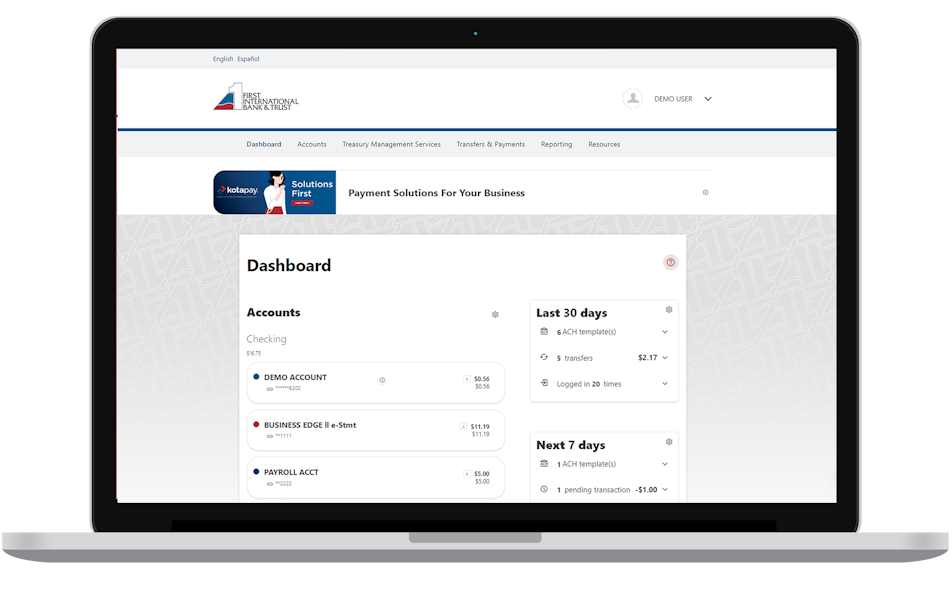

Explore the latest upgrades to our online banking services at First International Bank & Trust. We’re excited to introduce a range of new features that make managing your finances easier than ever. From enhanced reporting options to mobile access for ACH and Wires, our new experience will help you keep things simple so you can focus on your business. Get started using one of the options below or keep scrolling to learn more.

Initial Business Login

If you have not logged into our NEW Online Business Banking experience, click the button below. This step only needs to be completed once.

Get StartedReturning Business Users

After your initial log in, click the button below, or go to my.fibt.com.

Secure LoginLearn More

View tutorials and learn more about the NEW Online Business Banking experience through Frequently Asked Questions.

Learn MoreNeed to Know

ACH &/or Wire users must activate their hard token or authenticator app prior to utilizing these services. Please reference the resources below for information on your elected option.

Current account alerts set up within online banking will need to be re-established in the new online banking experience.

Quicken/QuickBooks connections will need to be re-established.

Recurring Internal Transfers will need to be re-established.

If you are an ACH Originator:

- Recurring payments or collections will need to be re-established.

- You will need to contact Treasury Management before submitting any ACH files that are over your daily limit. Files over their limit will not process and will need to be resubmitted after contacting Treasury Management.

Mobile Users: You will need to download our First International Bank & Trust mobile app. You will no longer utilize the FIBT Business App. Please see FAQ below for the links to the app stores.

New and Updated Features

Enhanced, customized reporting options including BAI2 format

Additional layers of security protection, including integration with two-factor authentication apps like Microsoft and Google Authenticator

In-app messaging and help tips

Ability to submit ACH & Wires in the mobile app

ACH & Wire payee dual control options

Integrated chat capabilities, including real-time troubleshooting

Logging in for the First Time?

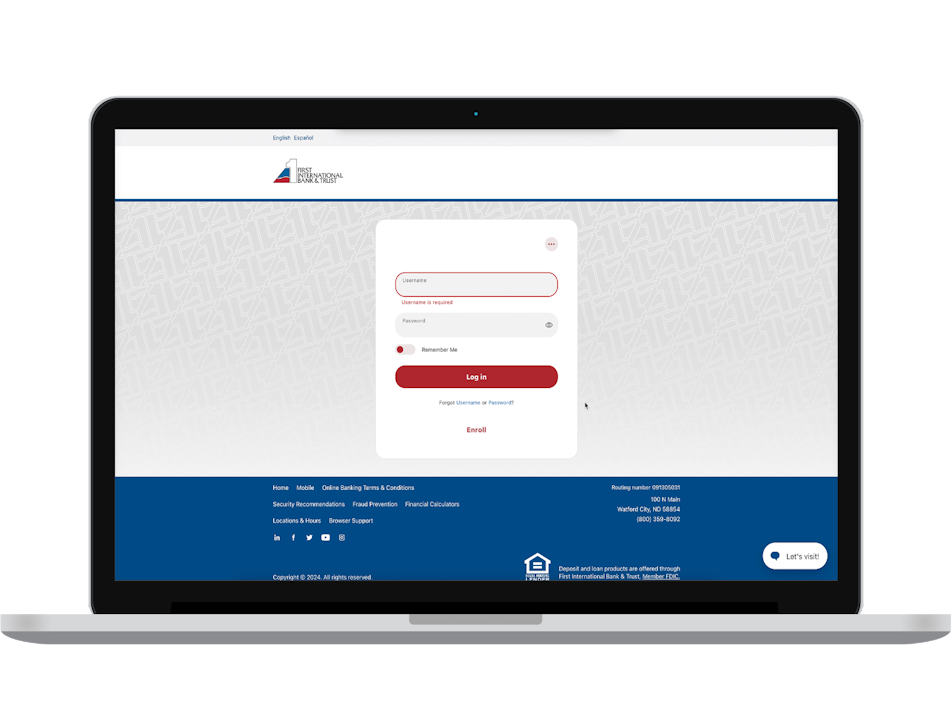

If this is your first time logging into the new online business

banking experience, follow these quick steps to get set up:

1. From the login page, click Forgot Password.

2. Click Reset my online business user password.

3. Verify Your Identity by entering:

- Your current Username

- Your Cell Phone with NO dashes

- Your Email

Note: If you have not provided your cell phone number to

FIBT, you will need to contact us at 800-359-8092

for assistance.

4. Select SMS Text to have a one-time code sent to

your mobile phone.

5. Verification Code

- Enter the 6-digit code sent to your mobile

phone number.

6. Create your new password using the requirement on

the screen and click Continue.

7. You will be prompted to create a Security Question

and Security Answer for verification and accept our

Terms & Conditions.

8. Click here if you are an ACH or Wire Originator

Frequently Asked Questions

- Logging In

Q: Will my online banking username change?

A: Your username will not change. When you log into online banking for the first time after the conversion, you will use the same username that you use today.

Q: Will my online banking Password change?

A: You will need to reestablish your password at first time login.

Q: Will I use the same security questions?

A: No. During your first login after the upgrade, you will be prompted to create a new security question and answer.

Q: Will I have to redownload or reset my Mobile Banking app?

A: You can delete your FIBT Business App and from your Apple App store or Google Play Store, search and download the FIBT Mobile app:

Q: Will I still be able to use biometrics to login to my online banking app?

A: Biometrics will not be available the first time you log into the new app. You will need to sign in with your username and password and then you can activate facial recognition.

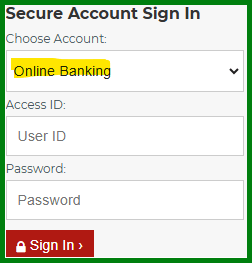

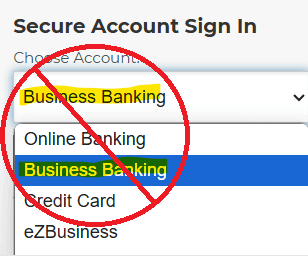

Q: How do I log in after I complete my initial steps?

A: Log in from the homepage www.fibt.com using the default dropdown: Online Banking and entering your User ID and new Password that you created. You will no longer log in under "Business Banking".

- Hard Token & Authentication App

Register your Two-Factor Authentication

- After logging into Online Business Banking, navigate to Resources and click Settings.

- Select Security.

- Under the Two-Factor Authentication section, click the pencil next to the 2FA APP option.

- Download an authenticator app like Google Authenticator, Authy or Duo from the App Store or Google Play Store and click Enroll.

- Scan the QR code using your preferred authentication app. Alternatively, you can manually enter the code into your app.

- If prompted, allow the authenticator app to access the camera on your phone.

- Follow the prompts in your app to complete the process and click Next.

- Click Done when finished and you will see a green ENABLED status.

If you do have a cell phone on file with FIBT, you may be prompted to register a 2FA during the login process.

Q: How do I register my Hard Token?

A: If you have ACH or WIRE access, below are the steps showing you how to register your new Hard Token. You will need to register 2FA or a Hard Token prior to initiating a Wire Transfer or ACH in the new online banking portal.

- After logging into Online Business Banking, navigate to Settings from your name in the upper right corner.

- Select Security.

- Click the pencil next to the TOKENS option and select New Hard Token > Register a hard token.

- Enter a nickname for your new token as well as the serial number on the back of the hard token you’ve received from us. Click Register Token.

You will need to enter two successive codes to complete the token registration process.

- Press and hold the button on your token until the first code appears and enter in the First Token Code field.

- Press the button again to receive the second code and enter in the Second Token Code field.

- Click Sync when you have both codes entered. (the two codes will be different)

- Once the token was synchronized successfully, the status will show Active.

Q: What do I do with my old Hard Token?

A: You will receive your new Hard Token in the mail, if you have not received your new token reach out to TMSupport@fibt.com

Please keep your old Hard Token until you receive a communication from us with further instructions.Q: What will my new Hard Token look like?

A: New Token:

Old Token:

- User Accounts

Q: Will all my online transaction history and bank statements transfer over?

A: Yes. You will continue to have two years' worth of transaction history and bank statement available in online banking.

Q: I have nicknames on my accounts. How will I know which account is which?

A: Your account nicknames will transfer over into the new online banking portal.

Q: Will all of my accounts come over to the new system?

A: Yes. The accounts you have now in online banking will transfer over to the new system with all the same access.

Q: Do I need to reset up transaction and account alerts?

A: Yes. Once you get logged in for the first time you can enable alerts by going to Accounts > Alerts.

Q: Will the new Online Banking system still have the capability to connect to QuickBooks or Quicken?

A: Yes, the same functionality for QuickBooks, Quicken and CSV exports will be available in the new system. QuickBooks users will need to go through a deactivation and reactivation process after the upgrade. Learn more here.

Q: Will my Bill Pay access change?

A: No. All of your bill pay payees, history and scheduled payments will remain the same.

Q: Will my ACH and Wire transfers I have set up in my Online Business Banking still be processed?

A: The templates for ACH and Wire Transfer will transfer over into the new online banking portal, however all recurring transfers will need to be rescheduled.

Q: Will I have to upload all my Positive Pay check issue files?

A: No. Your check issue files will transfer over into the new online banking portal. There will be no changes to the Positive Pay page.

Q: Will I have to reenter all my “authorization rules” for ACH Positive Pay.

A: No. Your ACH Rules will transfer over into the new online banking portal.

Q: Will I have to reinstall new drivers for Remote Deposit Capture (scanner) services?

A: No.

Q: What if I need to access my Online Banking during the scheduled downtime?

A: You will not be able to access online banking during the downtimes. Please reference your email for Online Banking downtimes.

Q: When will I be able to access the new Online Business Banking portal?

A: Communication will be sent with your go-live date. Watch your email for important information.

Q: Will my Lockbox access change?

A: There will be no changes to the Lockbox page.

- Contact

Q: Who do I contact if I have questions?

A: If you have any questions, please contact our Customer Care Team at (800) 359-8092.

- QuickBooks/Quicken Web Connect

QuickBooks

To disconnect online banking connection for accounts connected to our old online banking portal:

- Go to Transactions, then Bank transactions.

- Select the tile for the bank account you would like to disconnect.

- Click the Pencil Icon on the corner of that accounts box.

- Click Edit Account Info.

- Check the box next to Disconnect this account on save.

- Select Save and Close.

- Repeat steps for any additional accounts that apply.

To reconnect:

- Go to Transactions, then select Bank transactions.

- Click Link Account in the upper-right side of the screen.

- Type First International Bank & Trust and choose the correct option from the results.

- Enter your new FIBT Online Business Banking credentials and click Continue.

- Provide additional information, if requested.

- Ensure you associate the accounts for your financial institution to the appropriate account already listed under Which accounts do you want to connect? Choose the matching account in the drop-down menu.

Important: Do NOT select “+ Add New” unless you intend to add a new account to QuickBooks Online. If you are presented with account(s) you do not want to track in the QuickBooks Online Company, uncheck the box next to the Account Name. - After all accounts have been matched, click Connect and then click Finish.

Quicken Express Web Connect

- To deactivate online banking connection from our old online banking portal:

- Choose Tools > Account List.

- Click Edit on the account to deactivate.

- In Account Details window, click Online Services tab.

- Click Deactivate next to the service you want to disable. Follow prompts to confirm deactivation.

- Click Yes to the message confirming if you want to disable this service.

- Click OK to the confirmation message.

- Repeat steps for any additional accounts that apply.

- To reconnect accounts using your new online business banking credentials:

- Choose Tools > Add Account.

- Type in First International Bank & Trust in the search field and click Next.

- Enter your FIBT online business banking login credentials and click Connect.

- Ensure you associate the account to the appropriate accounts already listed in Quicken. Select Link to an existing account and select the matching account in the drop-down menu.

Important: Do NOT choose “Create a new account” unless you intend to add a new account to Quicken. - After all account have been matched, click Next and then Done.